IONIX: Your Partner for DORA Compliance and Cyber Resilience

In the modern era of digitized operations, even non-tech companies must prioritize cybersecurity and operational resilience. This especially applies to industries where security is of paramount importance, such as the financial industry. The latest regulation set by the EU, DORA demands high standards of security to financial help institutions withstand cyber threats and operational failures, ensuring the stability of critical financial services in today’s digital world.In this blog post, we’ll explore key aspects of DORA, who it applies to, and how Ionix supports compliance with the regulation.

What Is DORA?

The Digital Operational Resilience Act (DORA) is an EU regulation aimed at enhancing the ability of financial institutions to withstand cyber threats and operational failures. The regulation introduces robust cybersecurity measures, risk assessments, and incident response plans to maintain the reliability of critical financial services. DORA focuses on improving digital resilience across the financial sector and fortifying the industry’s capability to handle disruptions.

Who Is Affected by DORA?

DORA has a broad impact across the financial sector, applying to various institutions and service providers such as:

- Credit institutions

- E-money institutions

- Payment institutions

- Investment firms

- Central securities depositories

- UCITS management companies

- Crowdfunding service providers

- Crypto asset service providers

- Managers of alternative investment funds

- Administrators of critical benchmarks

- ICT third-party service providers

The Five Pillars of DORA

The requirements of DORA revolve around five key pillars:

- ICT Risk Management

Financial institutions must identify and manage risks related to information and communication technology (ICT) systems. This includes assessing vulnerabilities and implementing measures to mitigate risks.

- ICT-Related Incident Reporting

Institutions must promptly report technology-related incidents, such as cyberattacks or system failures, to regulators.

- Digital Operational Resilience Testing

Regular tests evaluate how well digital systems handle disruptions and simulate different scenarios to identify weaknesses.

- ICT Third-Party Risk Management

Managing risks associated with third-party vendors essential to financial operations, assessing and monitoring their cybersecurity and resilience.

- Information Sharing

Sharing insights and threat intelligence among financial institutions and regulators enhances awareness and response capabilities.

Biggest Challenges with DORA Compliance

While DORA introduces essential standards for digital operational resilience, achieving compliance can present several challenges for financial institutions. Here are some of the most significant hurdles your organization may encounter:

- Complex Regulatory Requirements:

DORA introduces detailed and comprehensive requirements across various aspects of operations, from ICT risk management to incident reporting. Adapting to these changes can be complex, particularly for larger institutions with intricate ICT infrastructures.

- Third-Party Oversight:

Managing and monitoring ICT third-party providers can be challenging, especially when dealing with numerous vendors with varying standards of cybersecurity and resilience. Ensuring consistent oversight and compliance across all providers requires significant effort.

- Resource Allocation:

Achieving compliance may necessitate substantial investment in terms of time, money, and personnel. This includes hiring experts, upgrading technology, and dedicating resources to monitoring and testing ICT systems.

- Training and Awareness:

Ensuring employees understand and adhere to DORA requirements can be challenging. Financial institutions need to invest in ongoing training and awareness programs to keep their teams informed and prepared.

- Maintaining Business Continuity:

Balancing the implementation of new compliance measures with maintaining smooth day-to-day operations can be difficult. Institutions must ensure that compliance efforts do not disrupt their core activities.

The Penalties for Non-Compliance

Non-compliance with DORA can lead to significant penalties, such as daily fines and periodic payments that can amount to 1% of the average daily global turnover for certain financial institutions. The regulation goes into effect on January 17, 2025, making it essential for organizations to prepare for compliance without delay.

As the clock counts down to the DORA deadline, the stakes for financial institutions are high. Beyond meeting regulatory requirements, adopting DORA is crucial for safeguarding the future of the financial industry. Strengthening cybersecurity resilience is key to thriving in the digital era, and proactive measures are necessary to secure stability and success in the future.

Preparing Your Organization for DORA Compliance

To prepare your organization for compliance with the latest DORA regulations, it’s important to take a strategic approach that encompasses not only the five pillars of DORA, but also other key elements of operational resilience and cybersecurity. Here are some strategies you can use to ensure readiness:

- Conduct a Comprehensive Risk Assessment:

Start by evaluating your current ICT infrastructure and identifying potential vulnerabilities. Implement measures to mitigate risks and ensure continuous monitoring to detect any new risks.

- Develop an Incident Response Plan:

Create a detailed incident response plan that outlines the steps your organization will take in case of a technology-related incident. Regularly test this plan through simulations to ensure its effectiveness.

- Enhance Third-Party Risk Management:

Assess and monitor the cybersecurity and resilience of third-party vendors critical to your operations. Establish strong contractual obligations and oversight mechanisms to manage third-party risks effectively.

- Invest in Training and Awareness:

Ensure your employees are well-trained in cybersecurity best practices and aware of DORA compliance requirements. Provide regular training sessions and updates to keep them informed.

- Establish Clear Reporting Channels:

Implement efficient and accurate reporting mechanisms for ICT-related incidents. Ensure your team understands the reporting process and its importance in complying with DORA regulations.

- Foster Collaboration and Information Sharing:

Participate in industry groups and forums that promote information sharing and collaboration. By working with other institutions and regulators, you can gain valuable insights and enhance your organization’s resilience.

- Stay Informed and Adapt:

Keep up to date with the latest developments in the digital finance landscape and DORA regulations. Continuously adapt your strategies and processes to address emerging risks and changes in compliance requirements.

- Leverage Advanced Tools and Solutions:

Utilize advanced technologies and solutions, such as those provided by IONIX, to strengthen your organization’s resilience and meet DORA requirements effectively. These tools can automate processes, enhance monitoring, and streamline compliance efforts.

How IONIX Supports DORA Compliance

Complying with DORA involves more than just meeting regulations; it’s about fortifying businesses, enhancing cybersecurity standards, and equipping organizations for the evolving digital finance landscape. IONIX supports DORA compliance through various means, including:

- ICT Risk Management:

IONIX provides comprehensive risk assessment tools to identify vulnerabilities in ICT systems. Continuous monitoring tracks and mitigates risks, and security controls enhance the reliability and security of digital operations.

- ICT-Related Incident Reporting:

Automated incident detection and response processes enable IONIX to quickly identify and contain technology-related incidents. Streamlined workflows allow for prompt and accurate reporting to regulators.

- Digital Operational Resilience Testing:

Simulation and testing tools from IONIX help evaluate the resilience of digital systems against disruptions. These tools assist in identifying weaknesses, enhancing response capabilities, and maintaining critical operations during challenges.

- ICT Third-Party Risk Management:

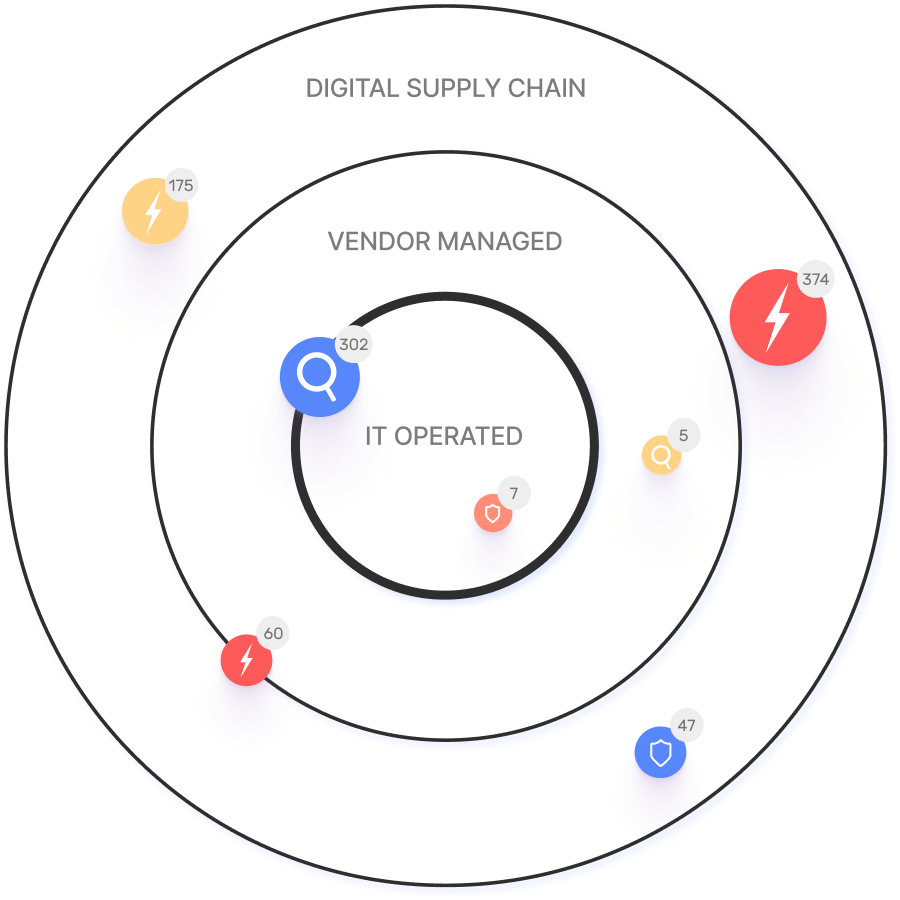

Utilizing patented Connective Intelligence, IONIX assesses risks, scanning digital supply chains, including assets outside the organization’s direct control. Active Protection safeguards vulnerable assets by automatically detecting and neutralizing threats.

- Information Sharing:

IONIX facilitates collaboration and information sharing among financial institutions and regulators through secure platforms. Sharing threat intelligence and insights enhances awareness and enables coordinated responses to emerging risks.

Investing in Cybersecurity Resilience for a Secure Future

As the DORA deadline approaches, IONIX offers the support and solutions needed to strengthen cyber resilience and achieve regulatory compliance. By providing advanced risk management, incident reporting, exposure validation, third-party risk management, and information sharing, IONIX prepares organizations for DORA compliance and helps them navigate the changing landscape of digital finance. Investing in IONIX today helps create a more secure and resilient future.