Mergers and Acquisitions (M&A)

Back To GlossaryMergers and acquisitions (M&A) represent strategic initiatives undertaken by organizations to expand their market presence, diversify their product portfolios, or achieve synergies through business consolidation. However, M&A transactions inherently introduce complexities and risks, including cybersecurity concerns related to the expanded attack surface and integration of disparate IT environments.

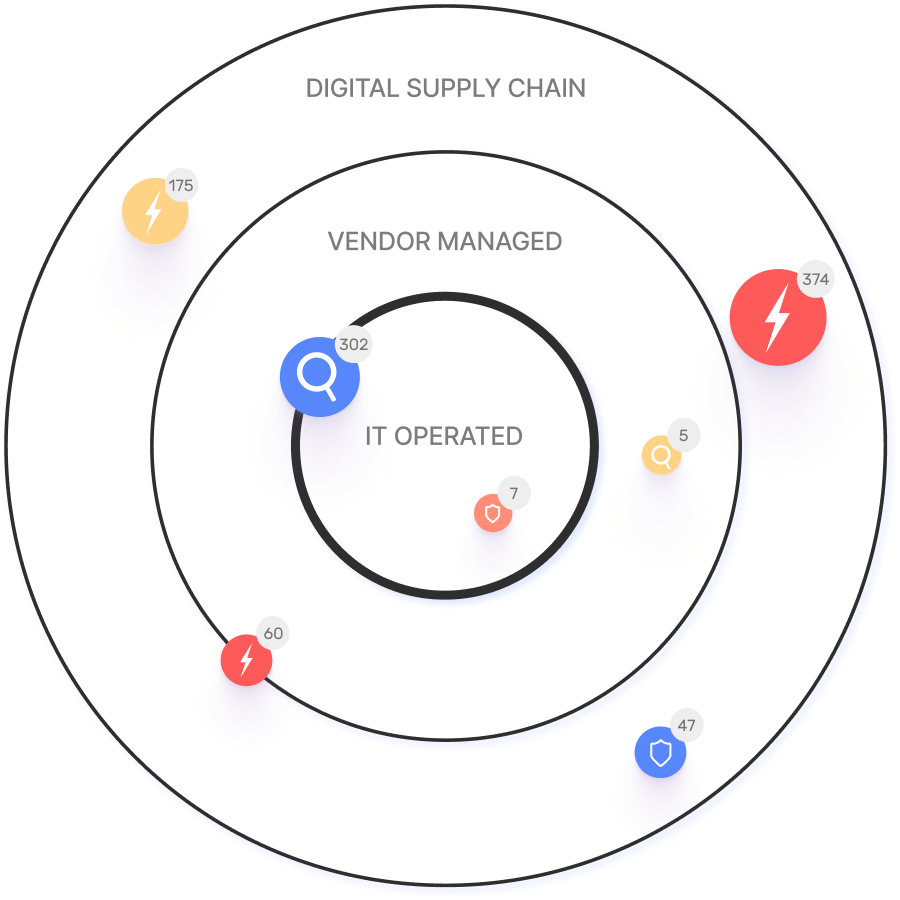

The combination of multiple business entities and IT infrastructures increases the exposure to potential vulnerabilities and threats, necessitating thorough due diligence and risk assessment processes to identify and mitigate cybersecurity risks effectively. External attack surface management plays a crucial role in the M&A process by enabling organizations to conduct comprehensive digital supply chain discovery and assess the security posture of potential merger or acquisition targets.

By leveraging external attack surface management tools and techniques, companies can gain visibility into the interconnected networks, applications, and assets of target organizations, identify potential vulnerabilities and exposures, and evaluate the overall cyber risk landscape before finalizing the transaction.

This proactive approach empowers organizations to make informed decisions, prioritize security investments, and implement remediation measures to address identified security issues before integration efforts commence. By mitigating cybersecurity risks early in the M&A lifecycle, organizations can minimize disruption, protect sensitive data and intellectual property, and ensure the success and long-term viability of the merged or acquired entity in an increasingly complex and interconnected digital ecosystem.